Learn how add JobKeeper for employees in Payroller

Learn how add JobKeeper for employees in Payroller with our simple guide below.

The JobKeeper Extension follows almost the exact same process as the previous JobKeeper period.

The same steps are applied for notifying the ATO that an employee is starting JobKeeper.

The same steps also apply for entering the wages and top-ups. However, the amount received under JobKeeper will be different.

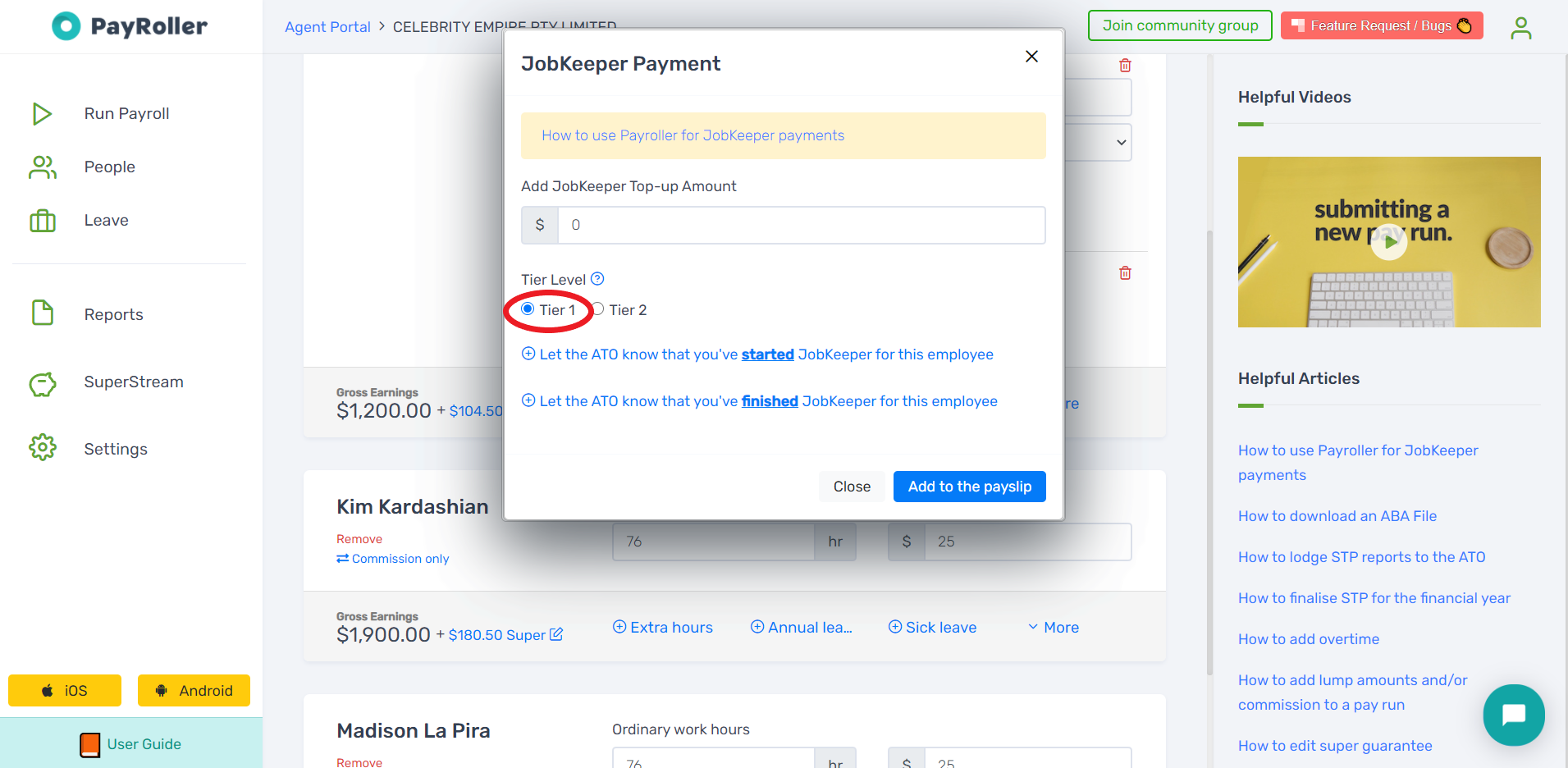

In your first pay run in the Extension period, you must notify which JobKeeper Tier your employee will receive.

See below for how adding JobKeeper looks in the Extension Period.

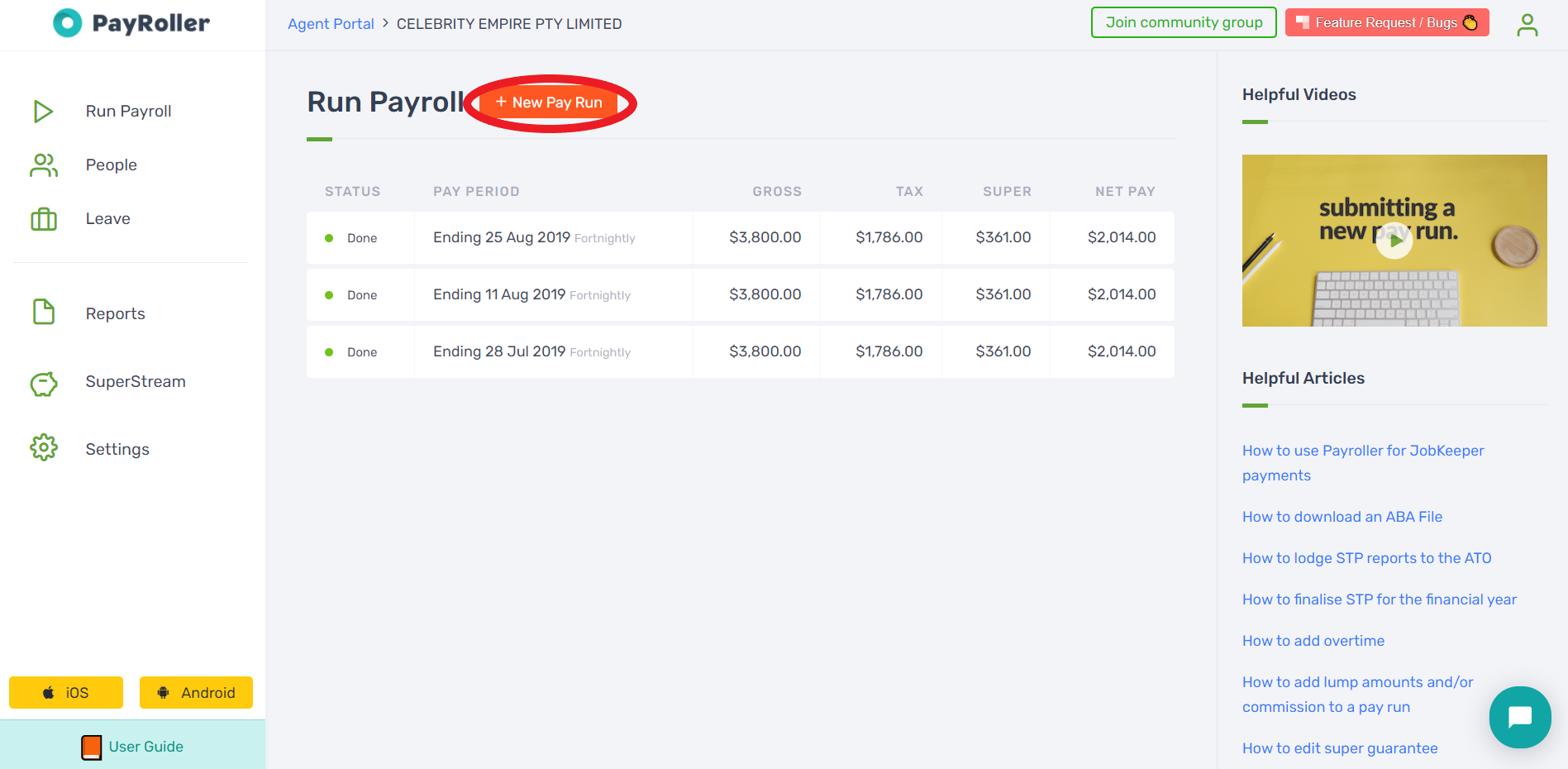

Step 1: Create a new pay run

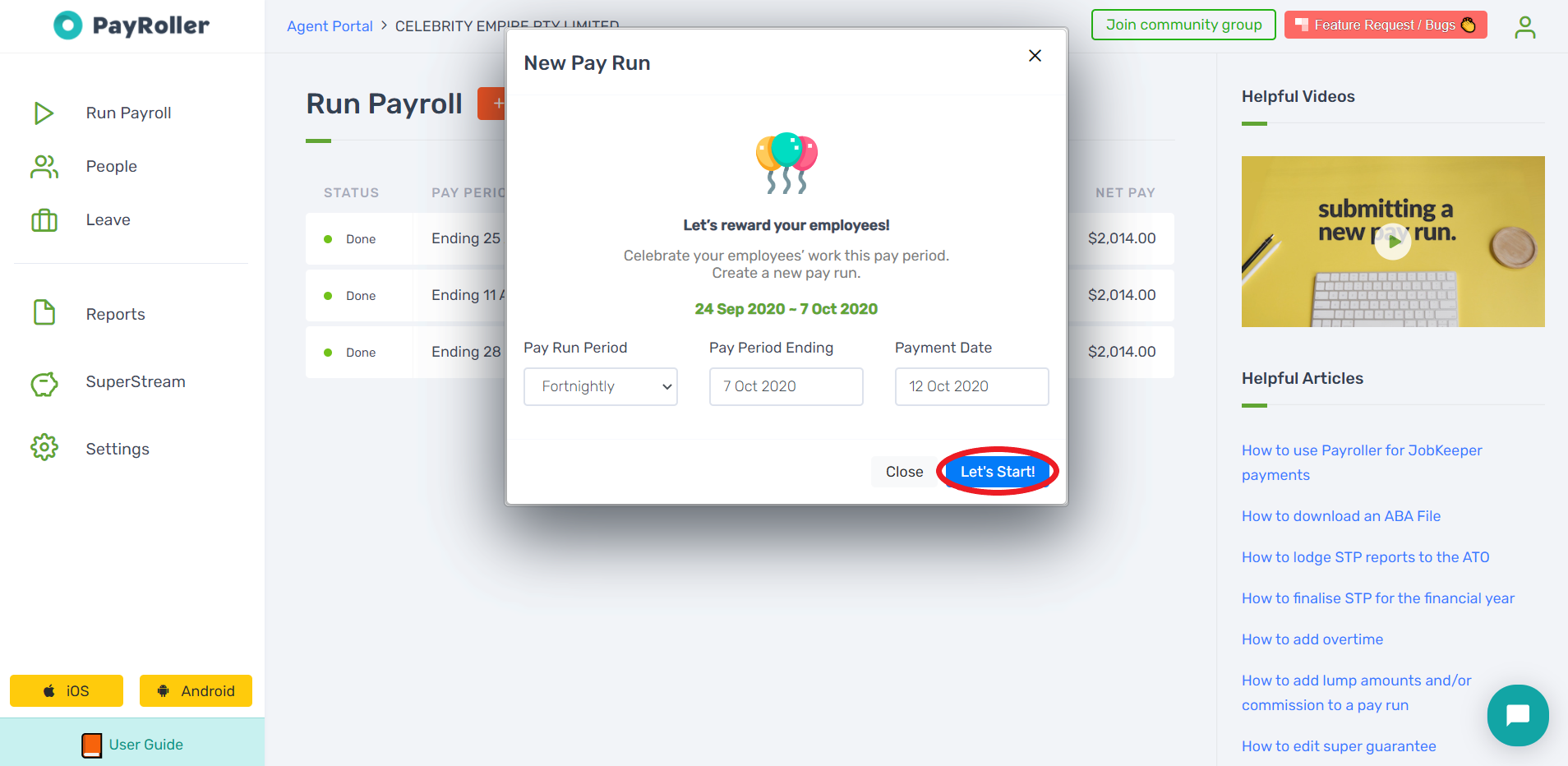

Step 2: Enter the pay period and click ‘Let’s Start’.

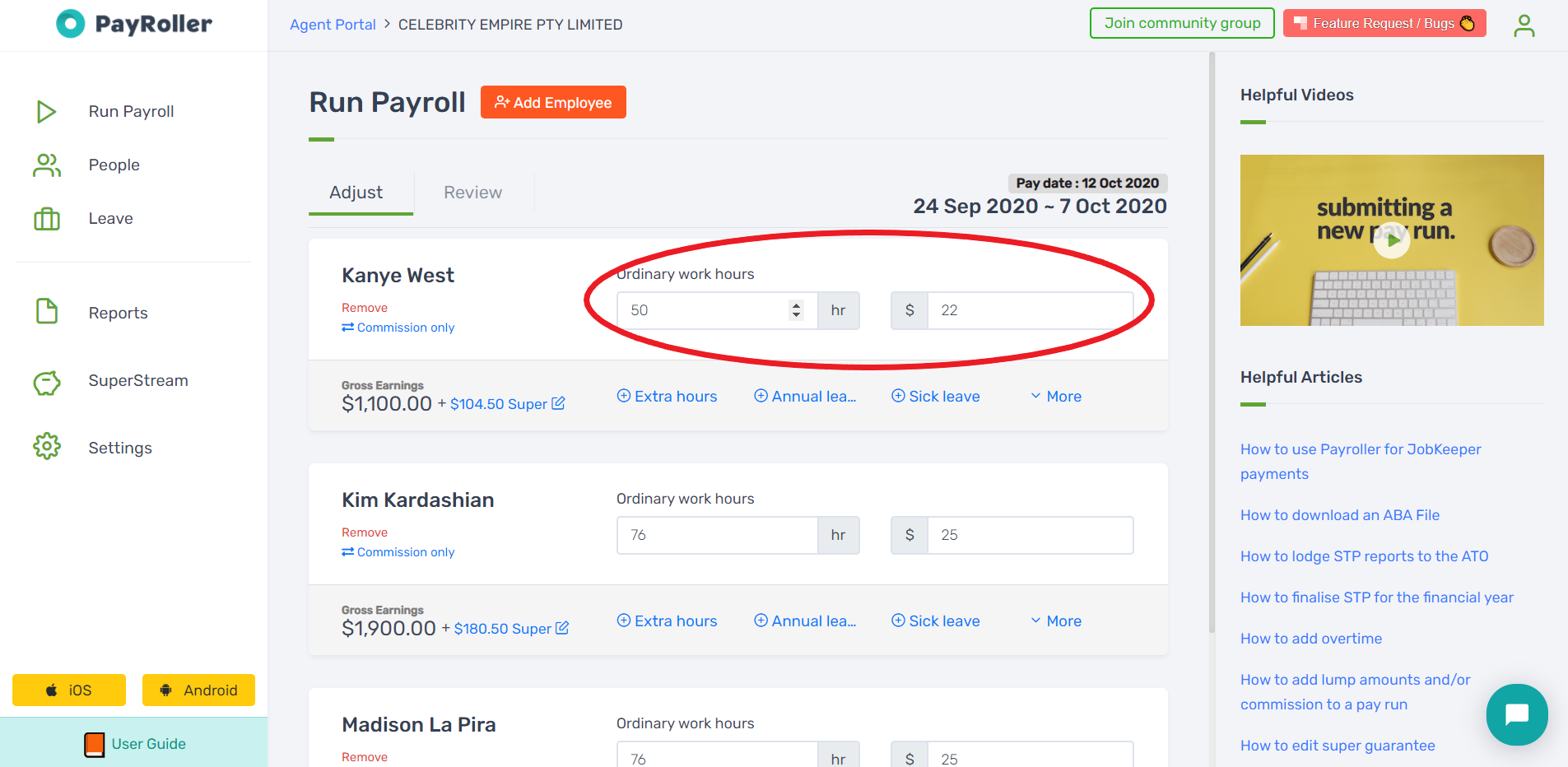

Step 3: Enter the employee’s wage

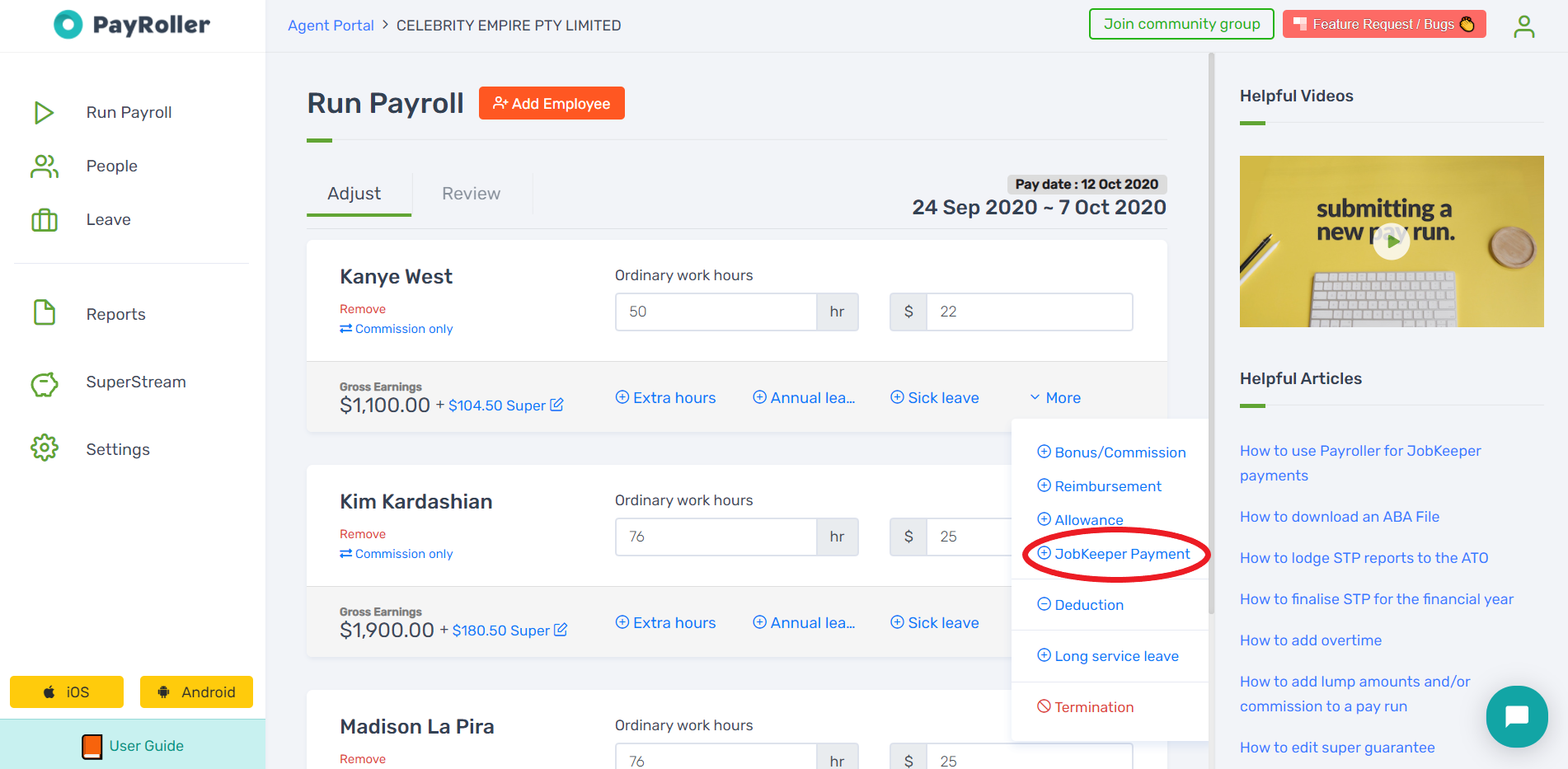

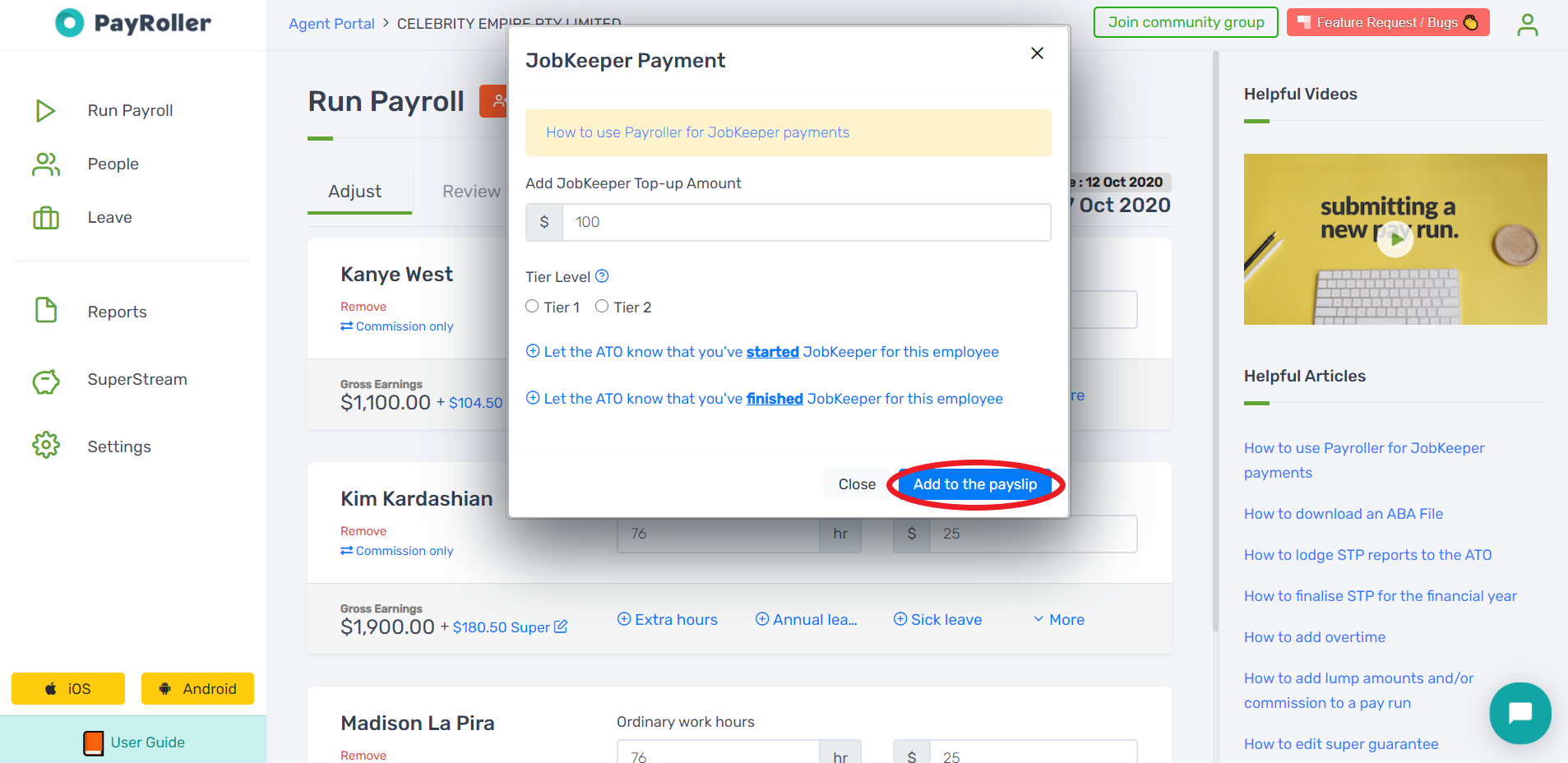

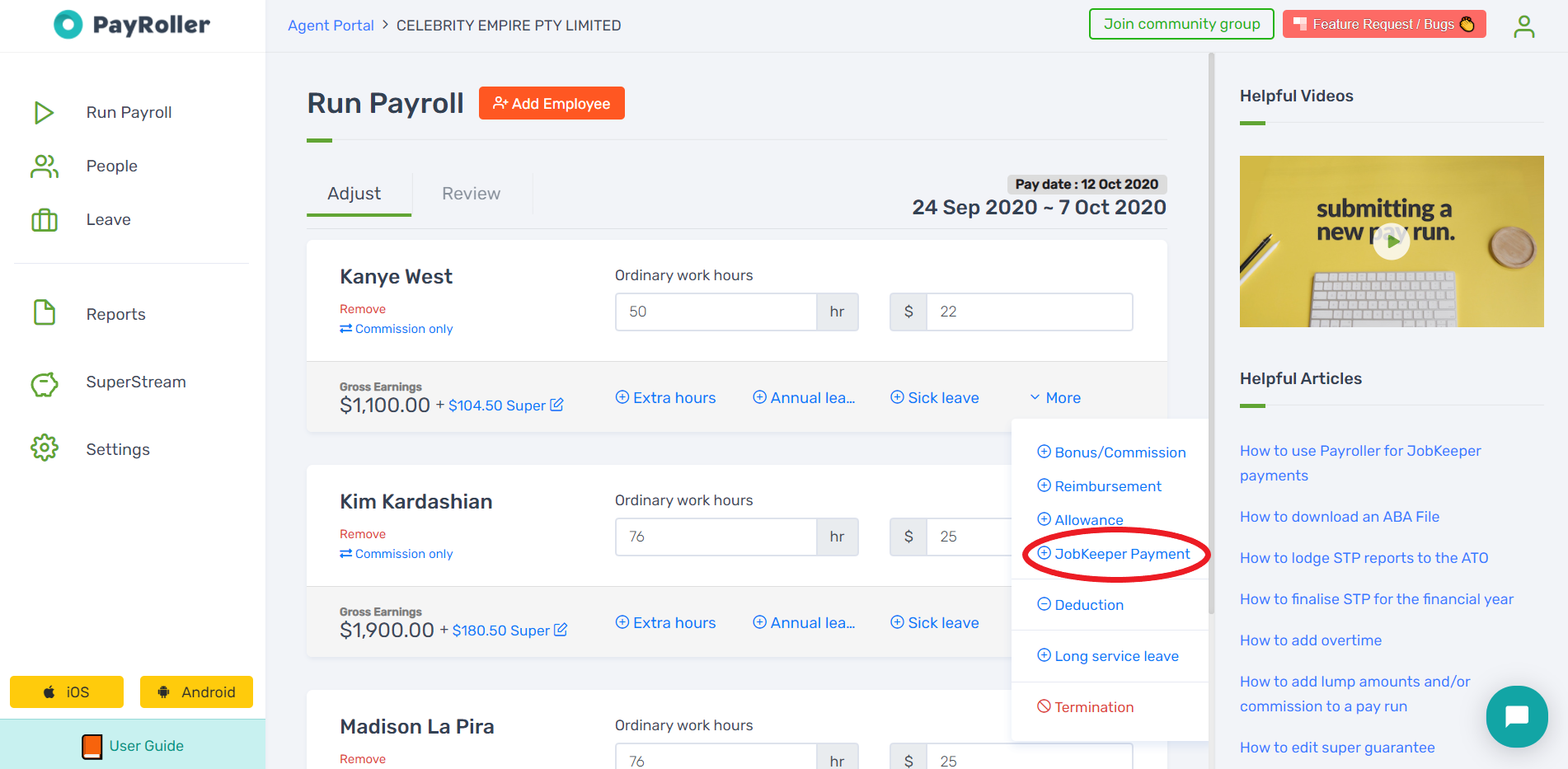

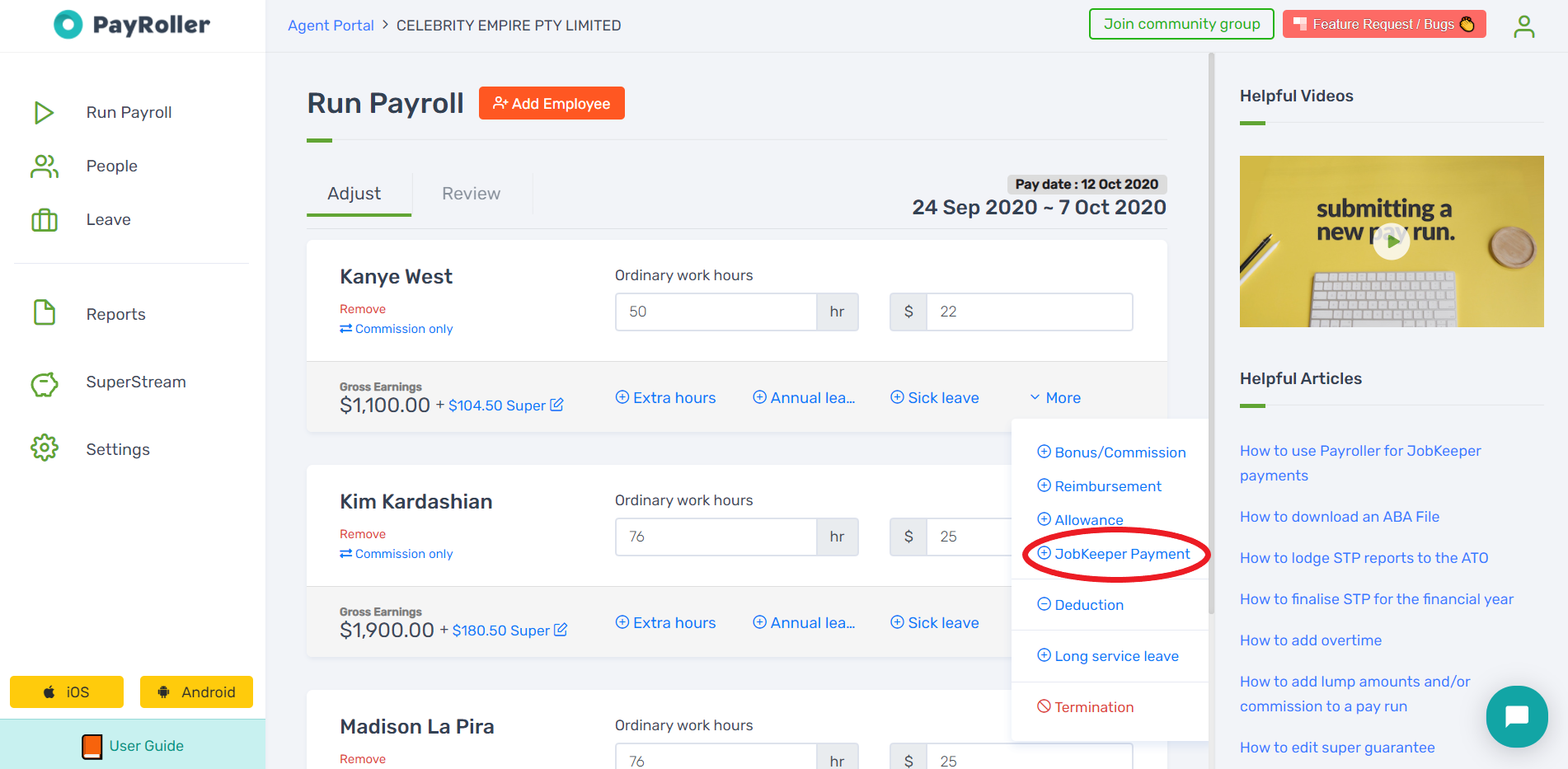

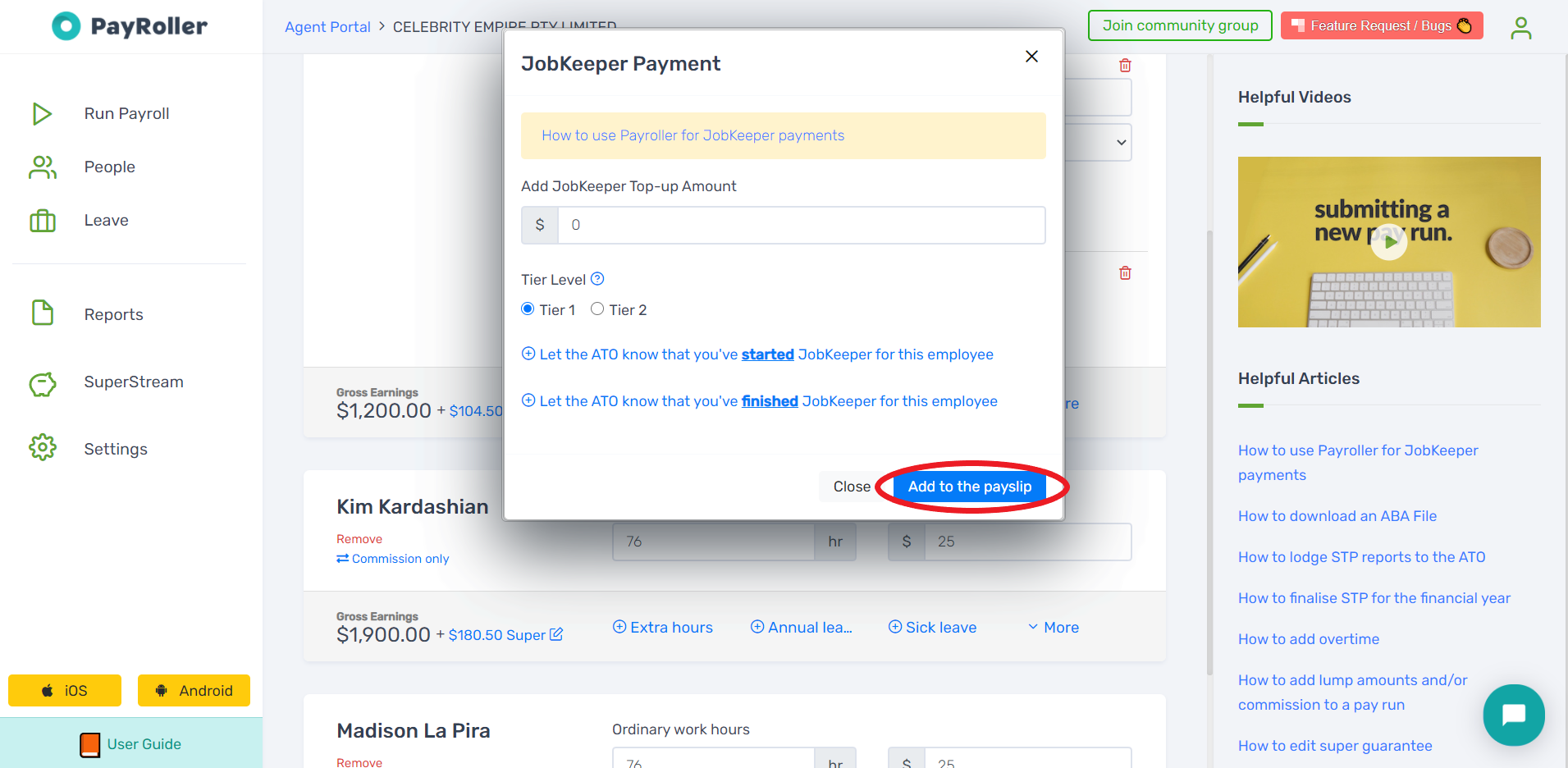

Step 4: To enter any top-up amounts necessary to meet the total JobKeeper value, click on More and then JobKeeper Payment. Enter the top-up amount and click ‘Add to the payslip’.

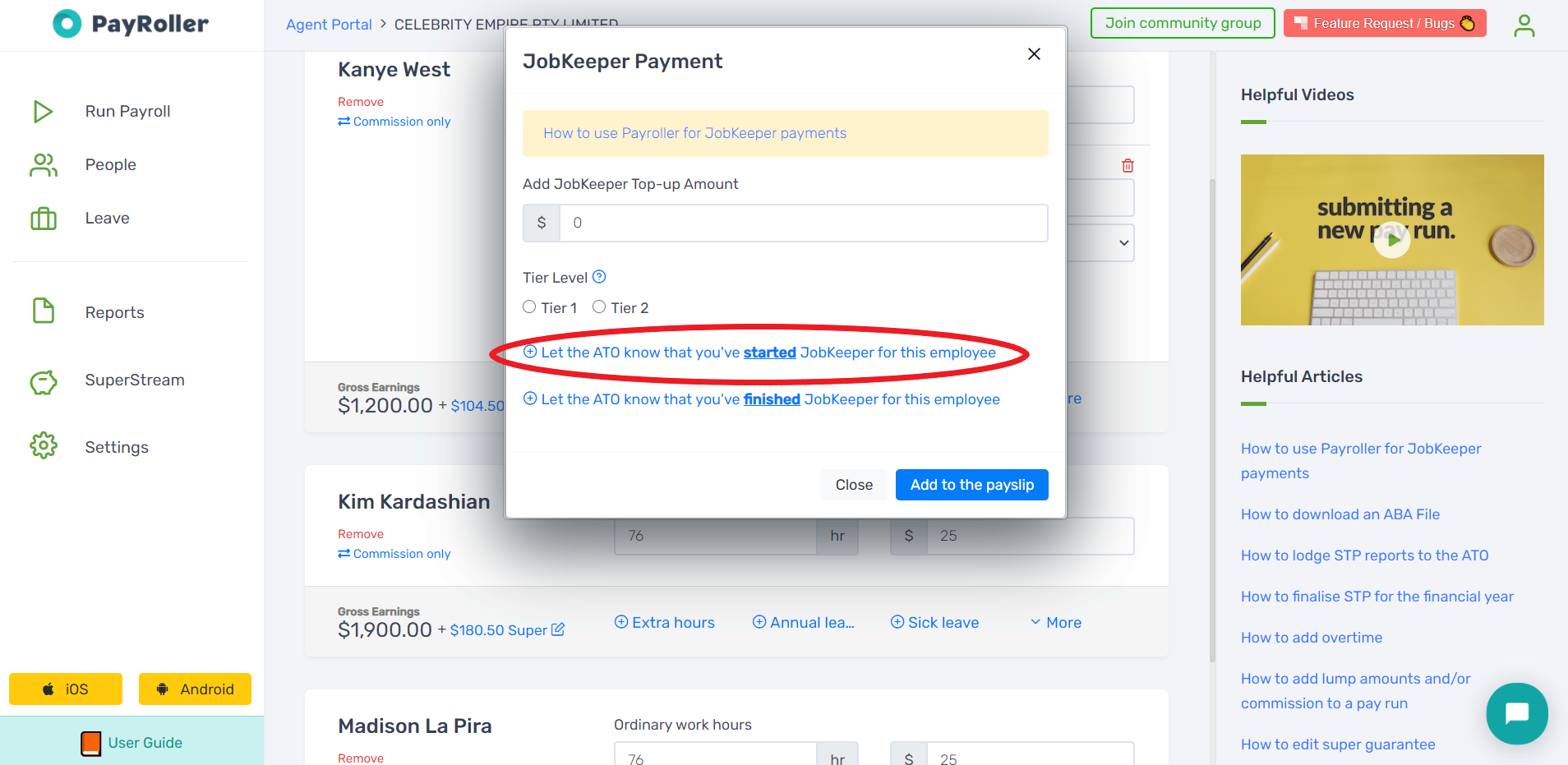

Step 5: If this is the first or last pay period that an employee receives JobKeeper, you will need to notify the ATO. To do this, click on More and then JobKeeper. Select either the ‘started’ or ‘finished’ option and the correct fortnight. Click ‘Add to the payslip’.

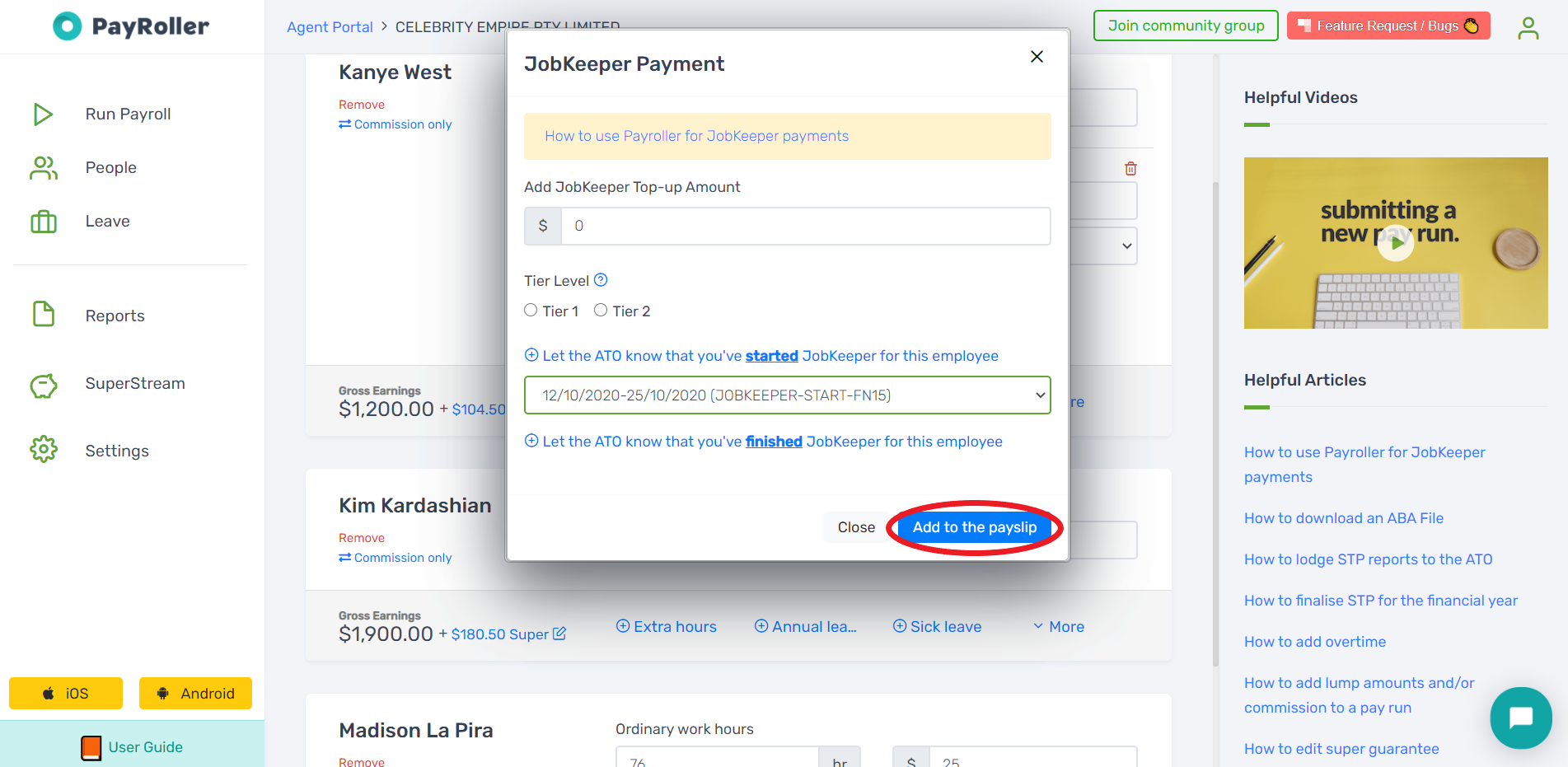

Step 6: In your first JobKeeper payment in the Extension, you will need to notify the Tier you are claiming. To do this, click on ‘More’ and then ‘JobKeeper’. Select the tier. Click ‘Add to the payslip’.

Step 7: Finish and report your pay run as normal

Salary Sacrifice with JobKeeper

If you wish to Salary Sacrifice all or part of your JobKeeper Payment, you will need to ensure that all of this amount is entered as Ordinary Earnings or Bonus/Commission before you add it to Salary Sacrifice.

It will not Salary Sacrifice correctly if it is in the JobKeeper Top-Up section.

Discover more tutorials & get the most out of using Payroller

Try out Payroller for free. Learn how to create and submit a pay run.

You can also get a Payroller subscription that gives you access to all features via the web and mobile app. Read up on our Subscription FAQs.

Invite your accountant, bookkeeper or tax agent to help you run your business payroll with our guide.