Learn how to finalise reporting for the financial year in Payroller

Learn how to finalise reporting for the financial year in Payroller with our simple guide below.

Please log in to www.payroller.com.au and follow the guide below to finalise STP.

At the end of each financial year, you will need to notify the ATO that you have finished reporting single touch payroll (STP) for your employees for the financial year. This is called a finalisation declaration.

In this guide, we will go over two options to finalise STP and finalisation statuses in Payroller.

Please note that if you edit or add a pay run within a financial year that you have previously finalised you will need to make sure to finalise STP again.

Option 1: Using the ‘Finalise STP’ feature

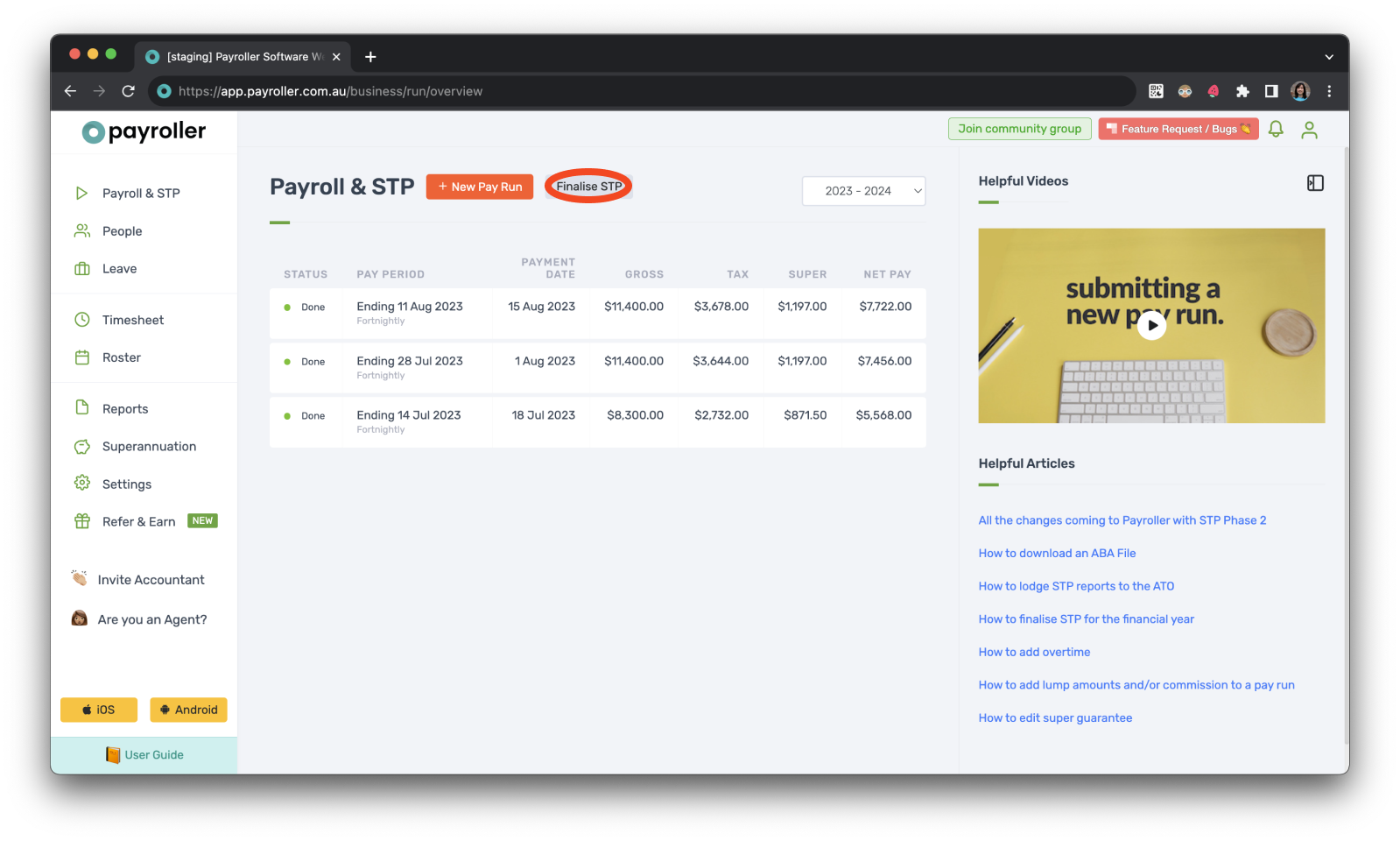

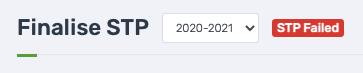

Step 1: Click on ‘Finalise STP’.

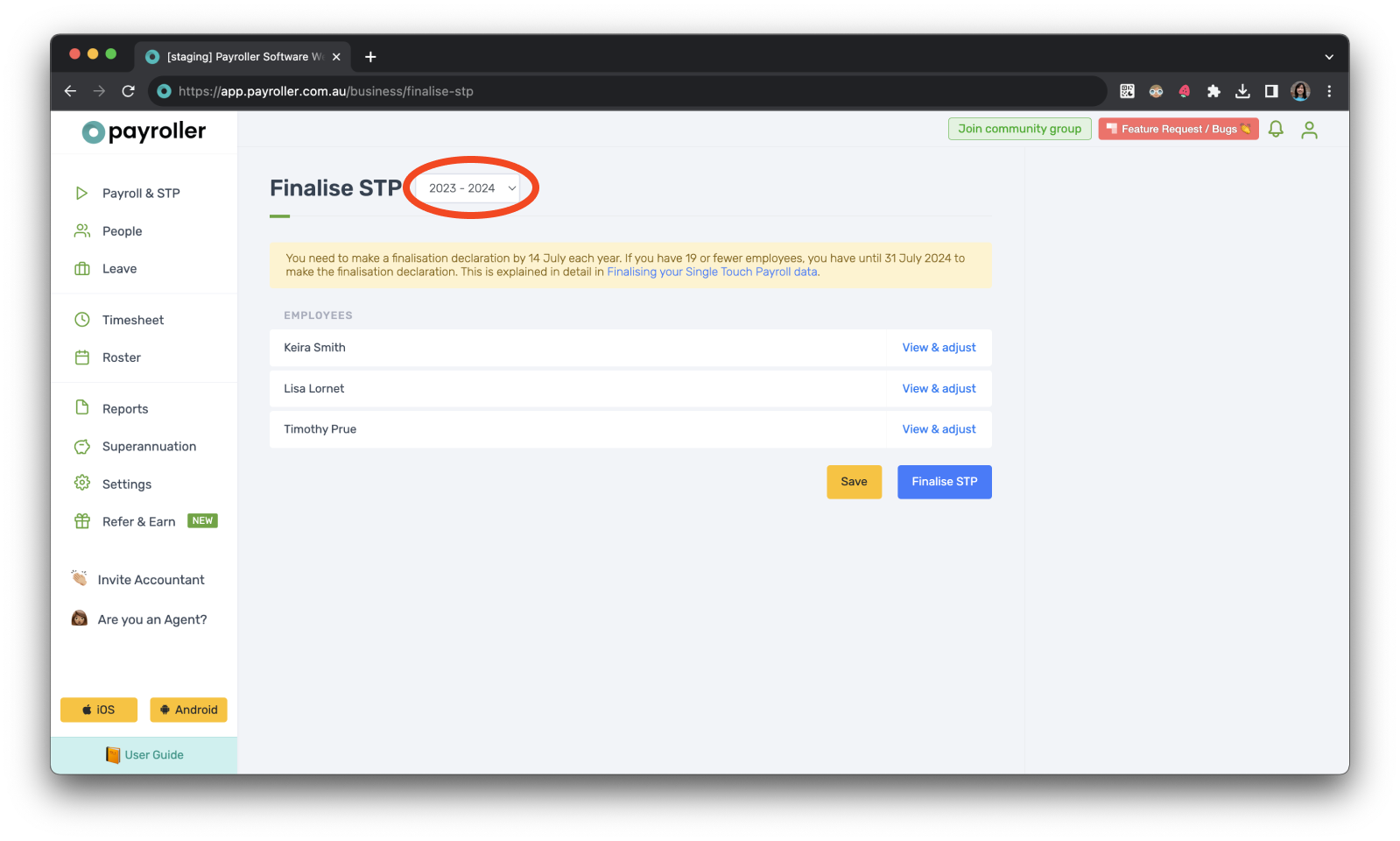

Step 2: Select the financial year you are finalising STP for.

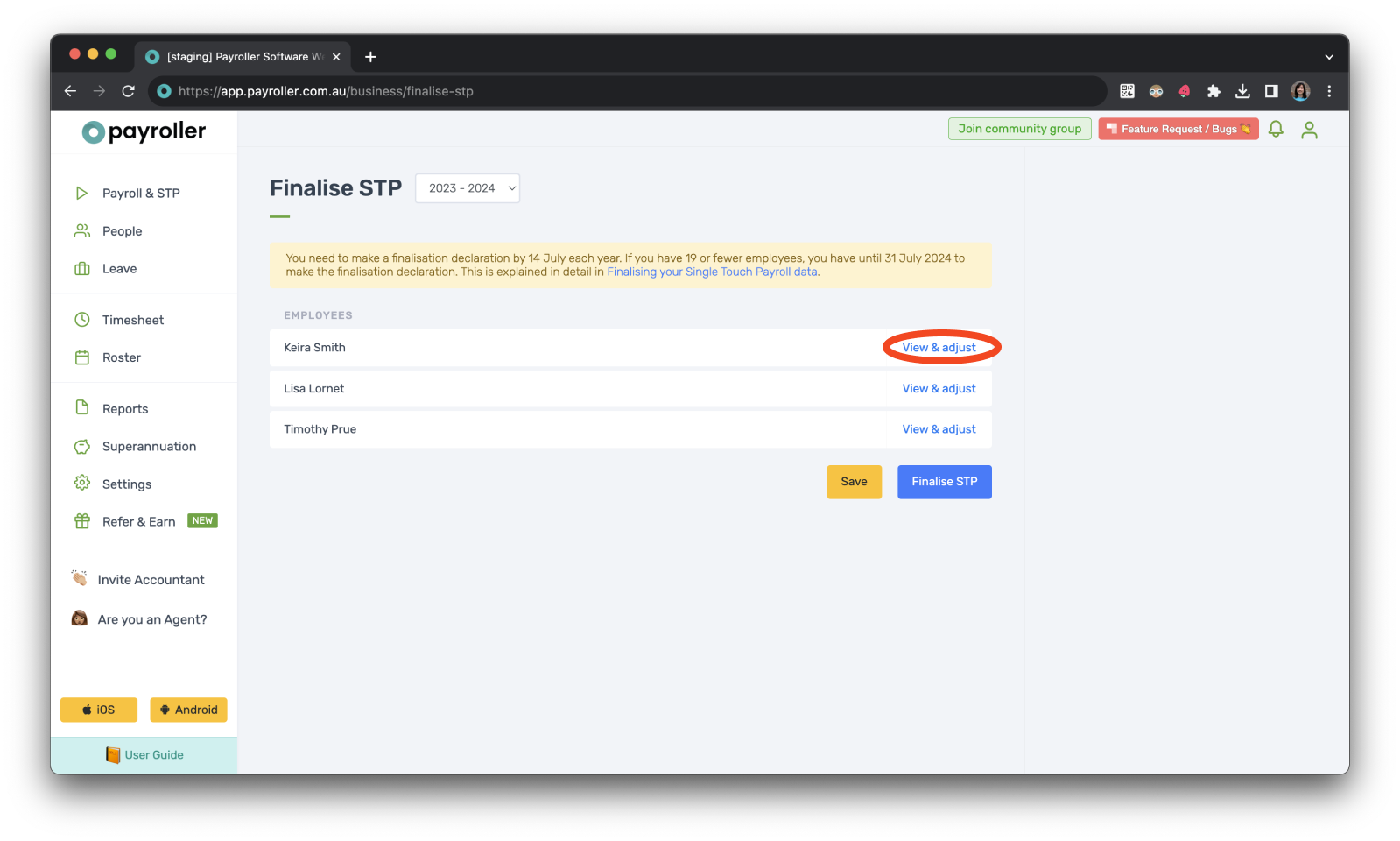

Step 3: Select ‘View & Adjust‘ for the first employee.

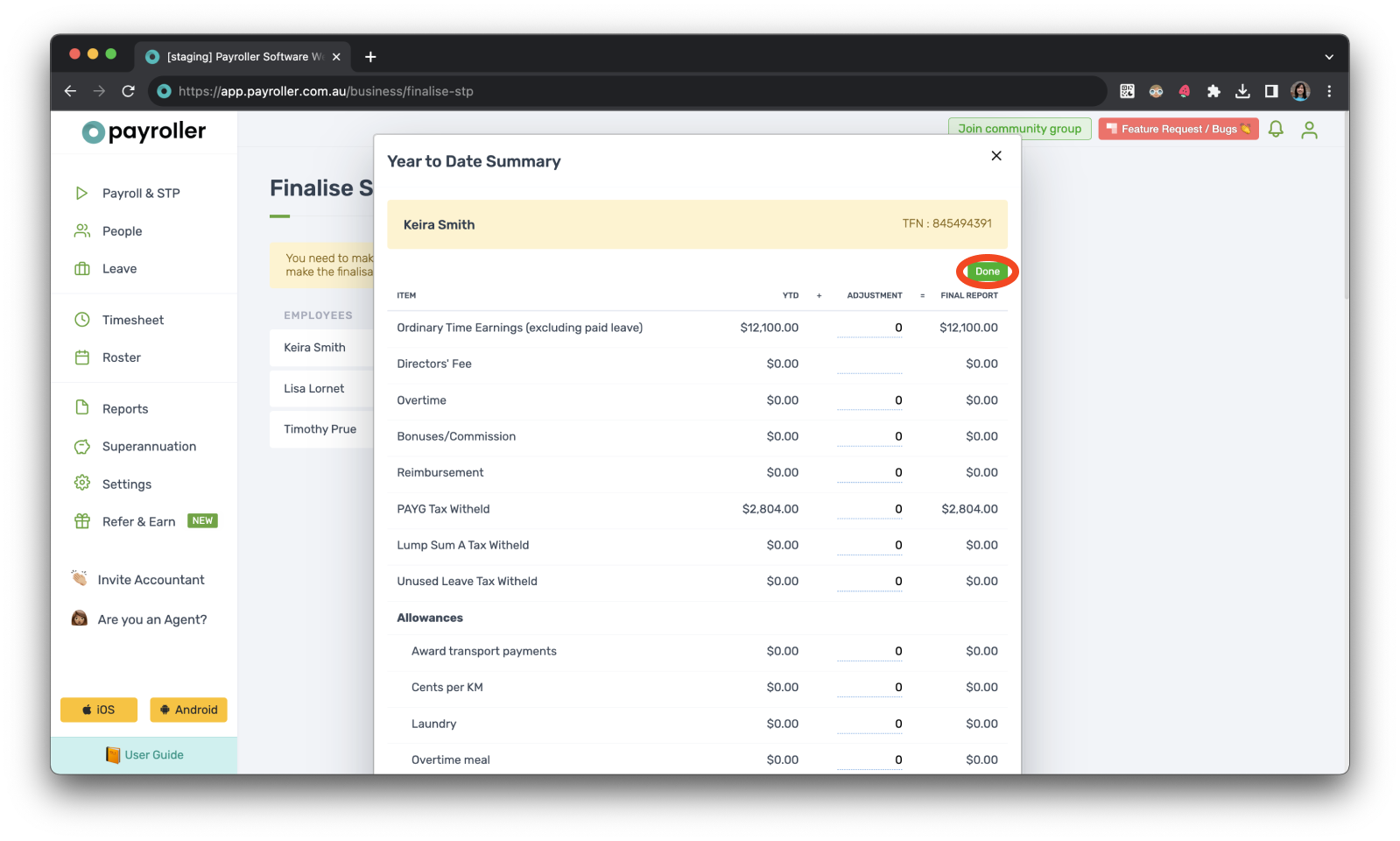

Step 4: Adjust the YTD Summary as needed and Click ‘Done’.

Please note that if you are currently on STP Phase 2 each figure is reported individually and therefore Ordinary time earnings are inclusive of amounts that have been salary sacrificed. Once a submission has been made the ATO will deduct the salary sacrifice amount from the total gross.

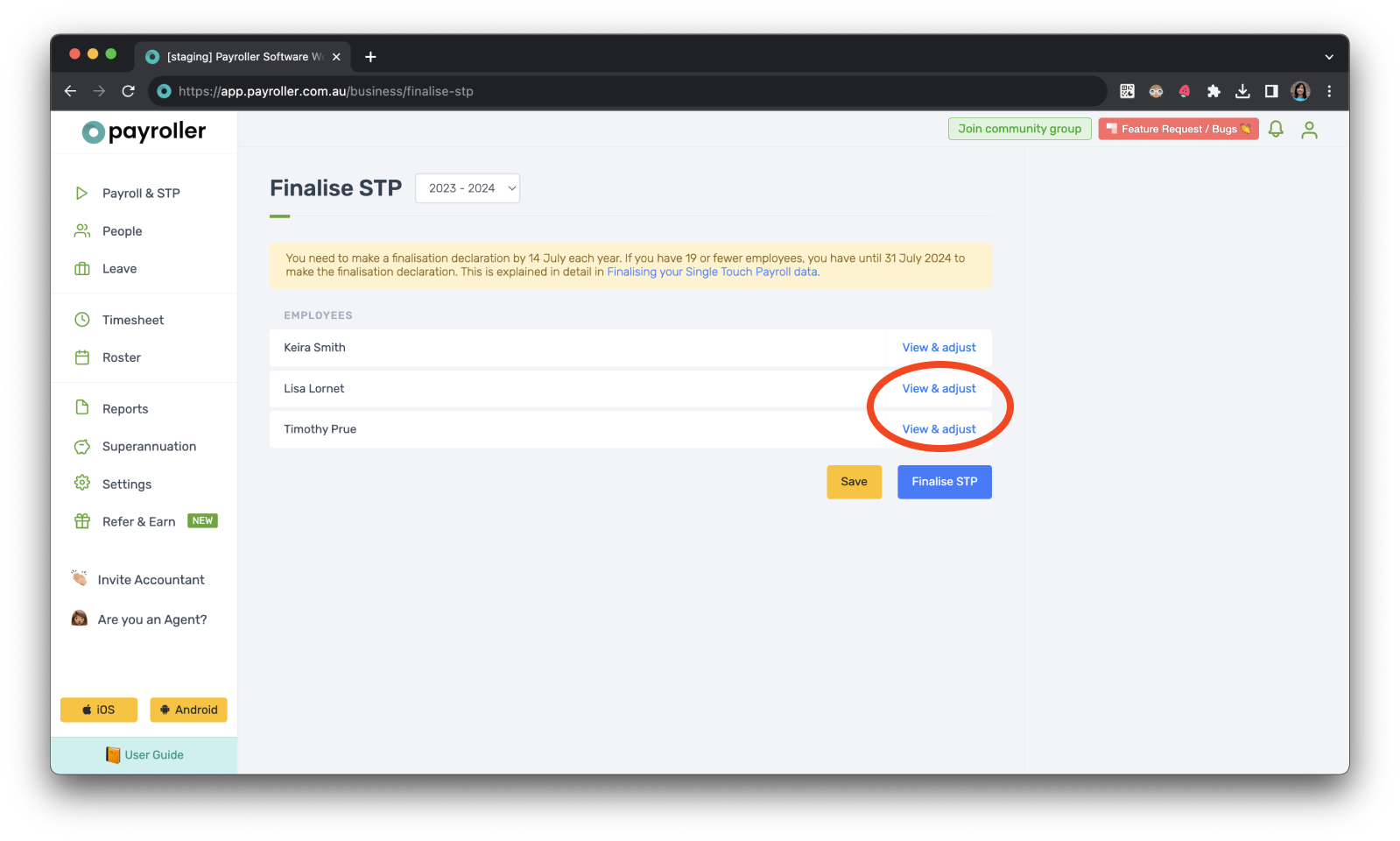

Step 5: Repeat the process for any other employees by clicking ‘View & Adjust‘.

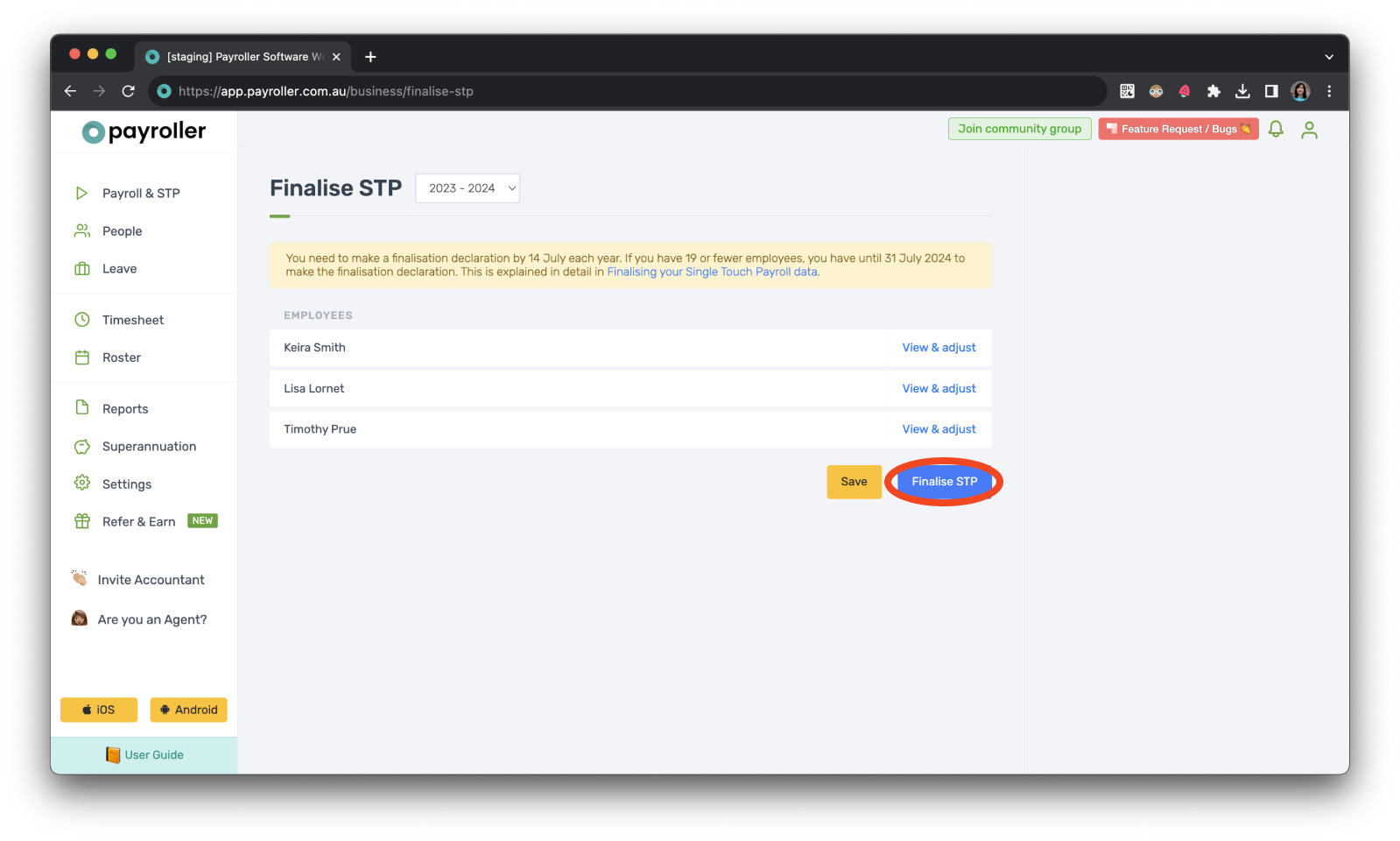

Step 6: Once you have finished your adjustments and would like to submit STP, click ‘Finalise STP’.

If you have made some changes to your finalisation but would like to finalise STP at a later stage you can select ‘Save’, which will save your changes as a draft.

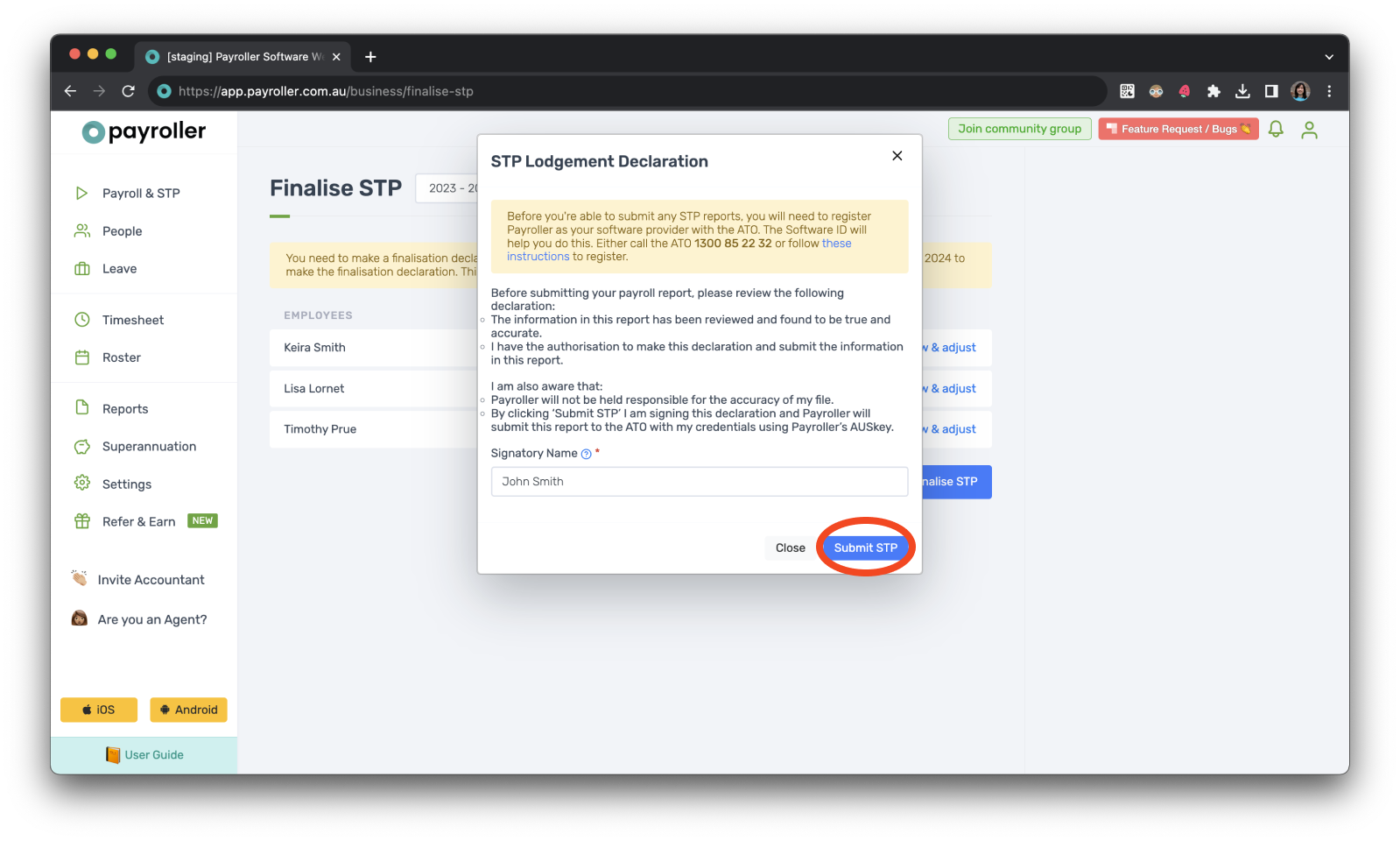

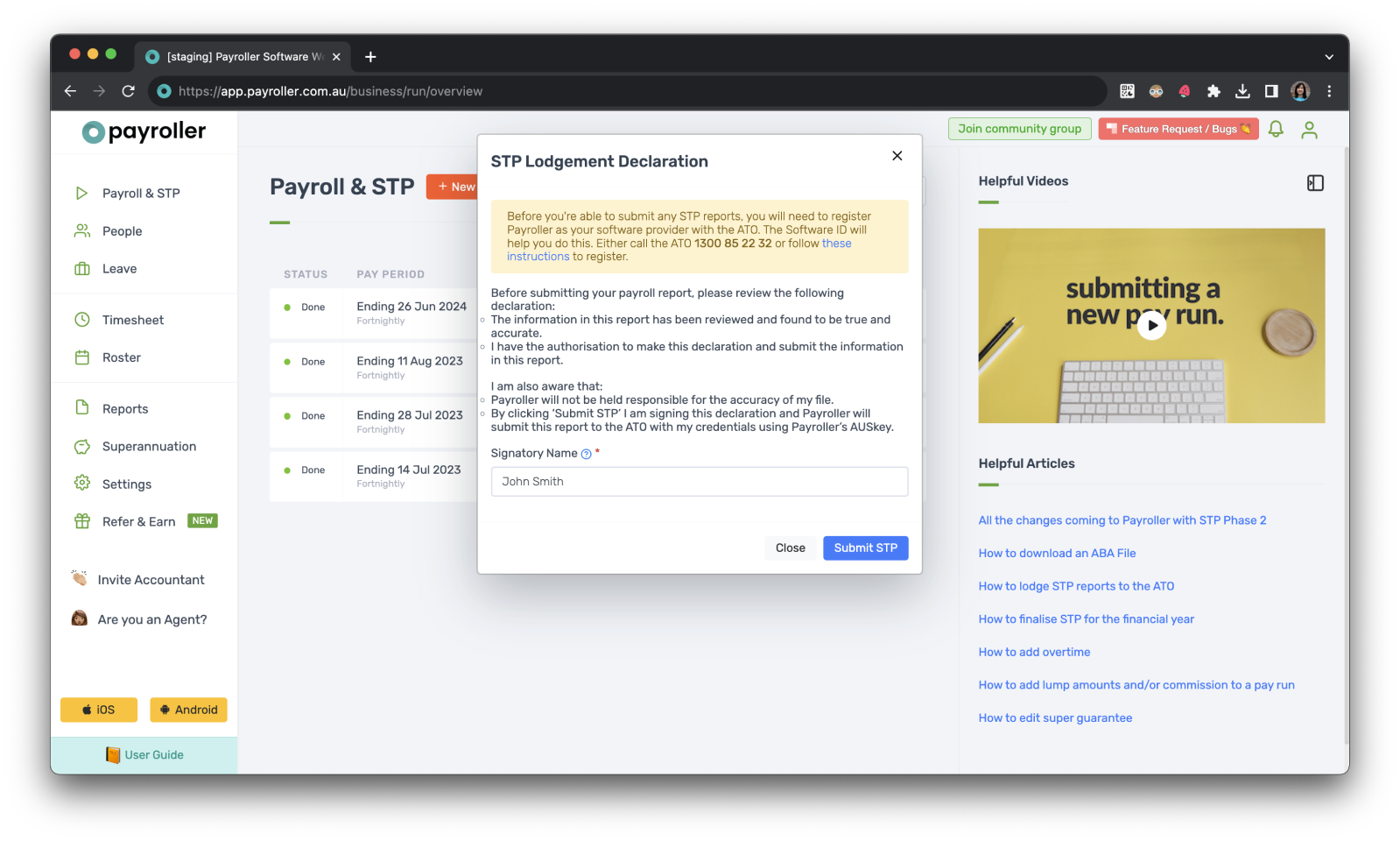

Step 7: Complete the STP declaration and select ‘Submit STP’.

You can edit and finalise STP several times. Any edits and additional finalisation submissions will update the previous STP finalisation for that financial year.

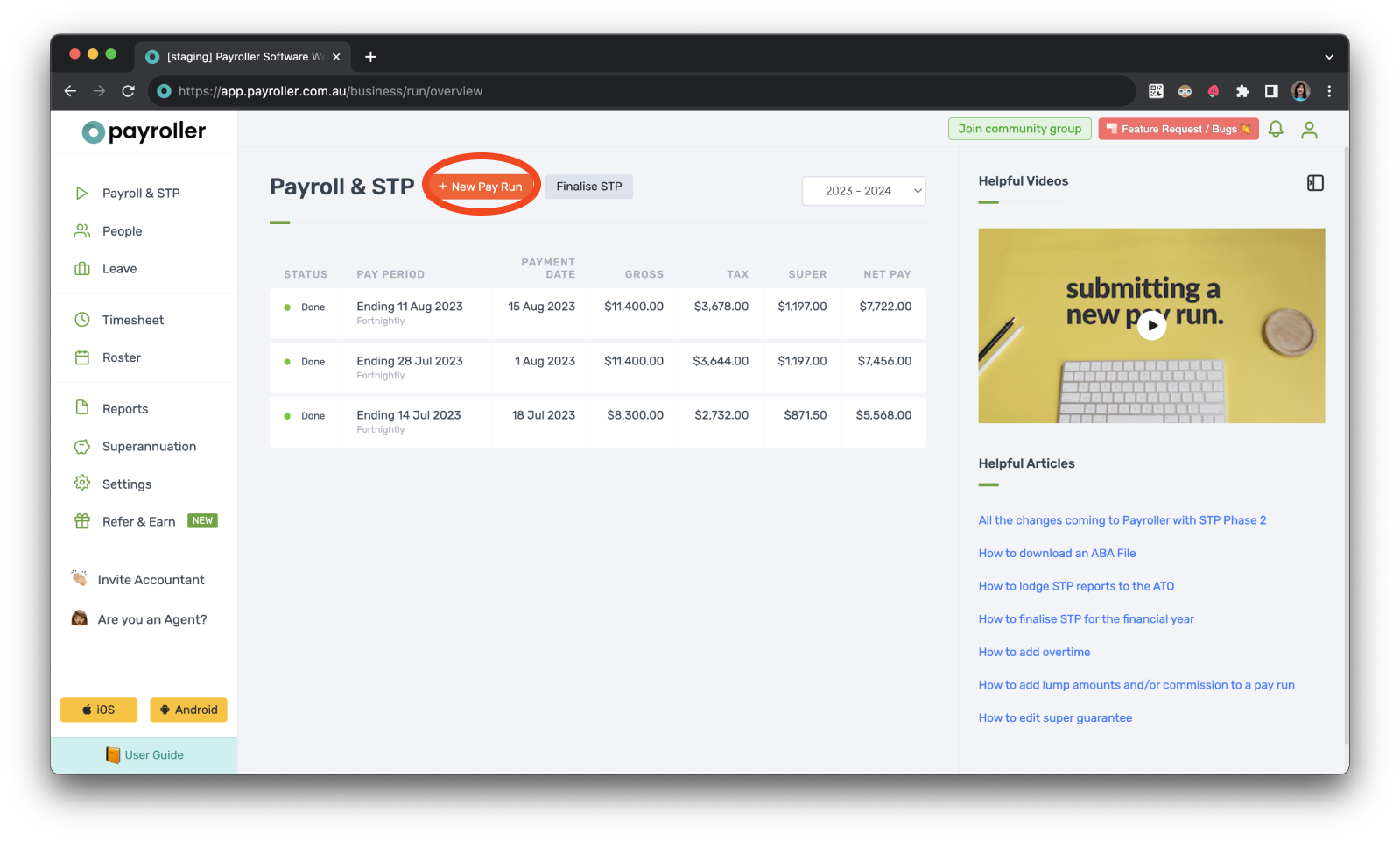

Option 2: In your final pay run

Step 1: Go about adding the pay run as usual.

Your final pay run for the financial year should be the one where the payment date is either on or before the 30th of June.

When finalising STP, Payment Dates falling on or after the 1st of July will fall into the next financial year by the ATO.

If you have already created the pay run for the financial year you can go ahead and edit the pay run and follow step 3.

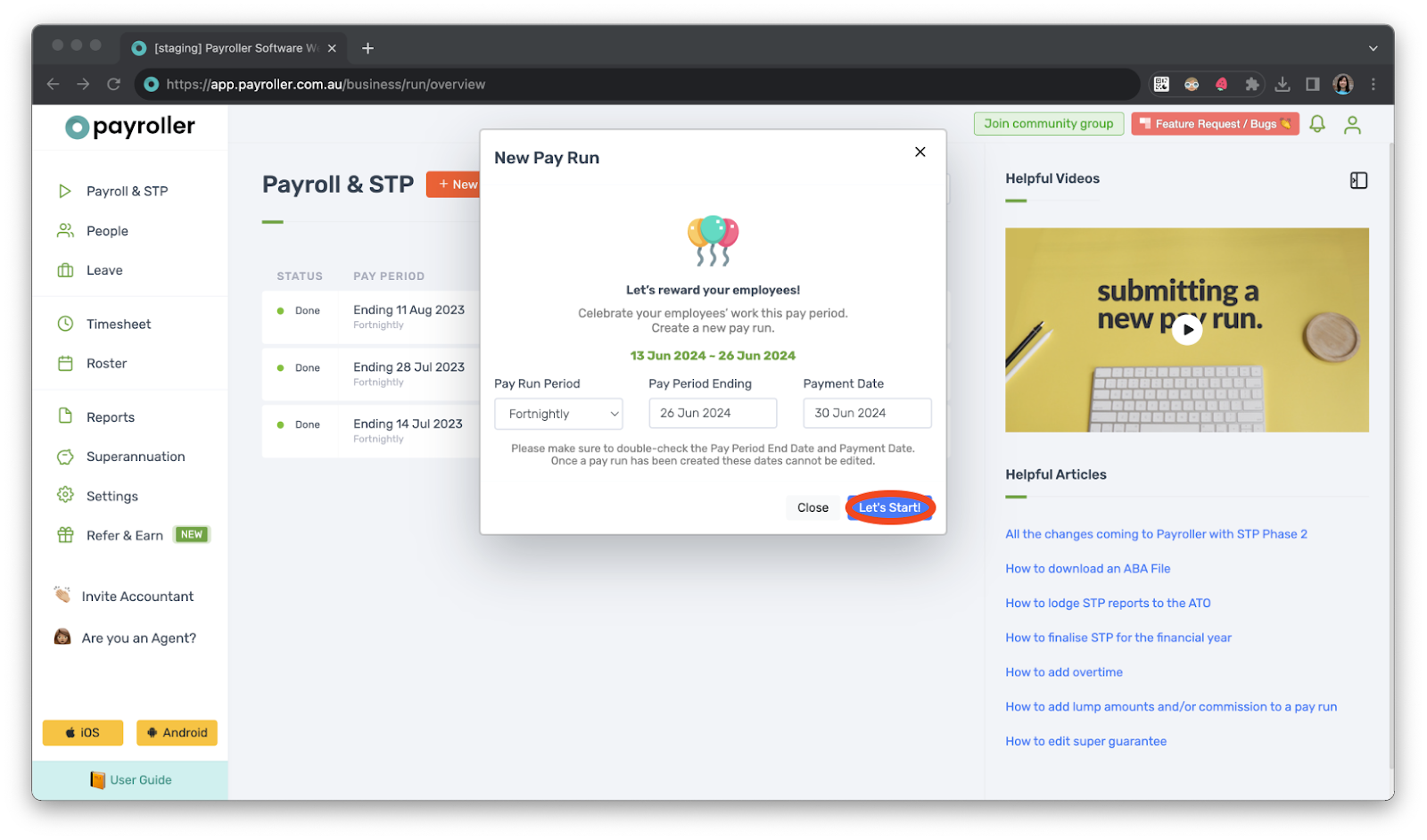

Step 2: Once you are happy with the date, select ‘Let’s Start!’.

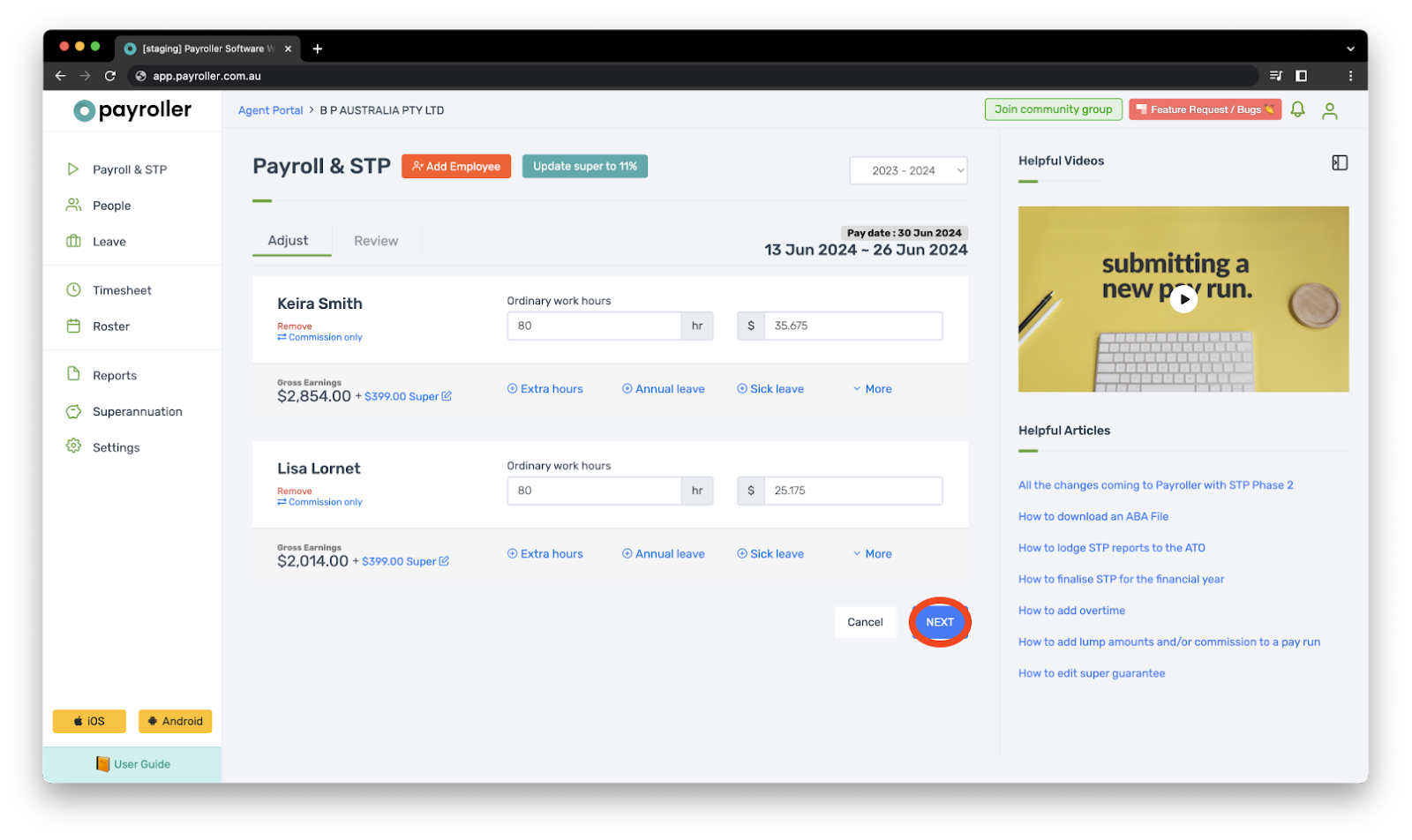

Step 3: Add and review your pay run as required and select ‘Next’.

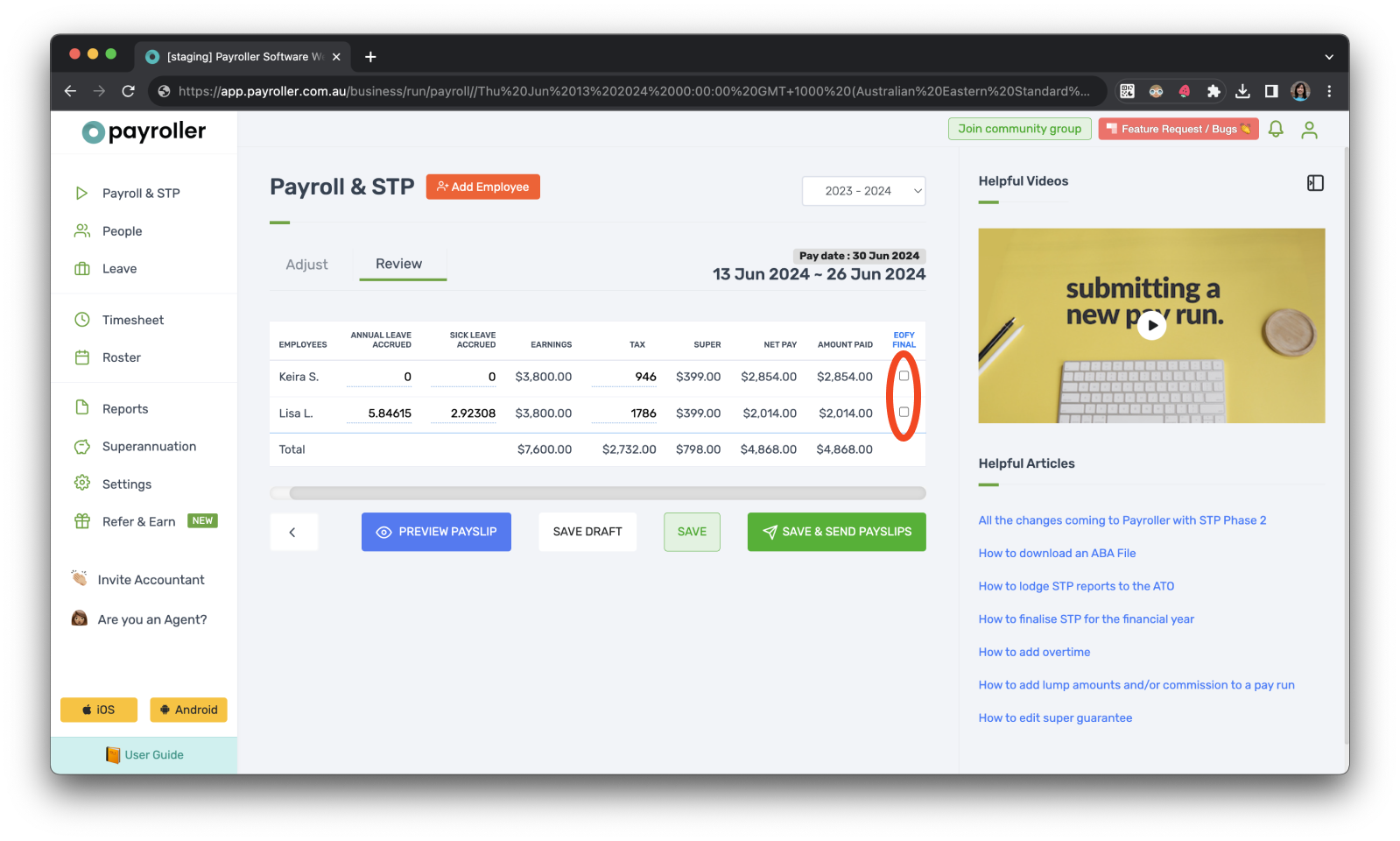

Step 4: Once you get to the Review section, there will be a heading that says EOFY Final.

Underneath the heading will be boxes that you can tick.

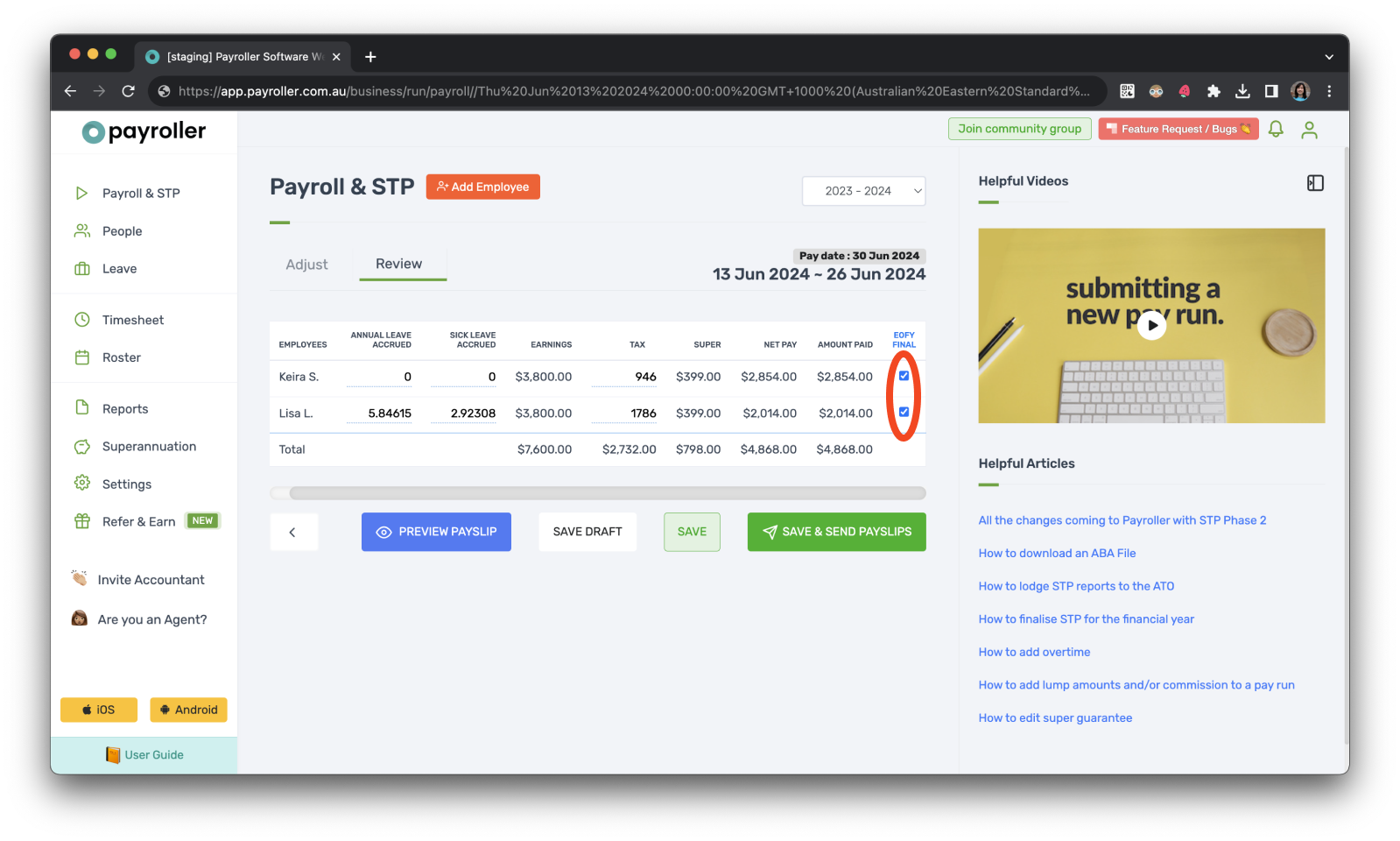

Step 5: Tick the boxes for all the employees that you wish to finalise reporting for the relevant financial year.

Step 6: Click ‘Save’ or ‘Save & Send Payslips’ and fill out the STP declaration.

The ATO will now be notified that you have finished STP reporting for the financial year.

If you have already finished your final pay run and you didn’t tick these boxes, you can edit the pay run and tick the boxes. From there, you will need to report STP for a second time.

If you accidentally ticked this box before you realised what it meant, go back and edit the pay run you did it on. Untick the boxes and resubmit the STP.

Different finalisation statuses and what they mean

There are four different types of statuses for STP finalisation.

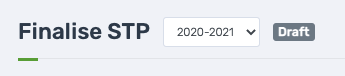

Draft: Any adjustments that are saved but not yet finalized for STP.

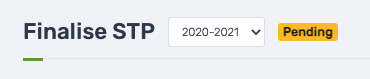

Pending: Once you submit STP, this will show up as pending till it has been finalised from the ATO.

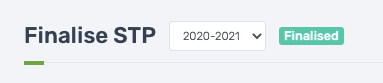

Finalised: STP that has been finalized and submitted to the ATO.

STP Failed: STP could not be submitted to the ATO.

During the end of the financial year, there may be some delays in processing, due to an increase in submissions during this time. Please allow up to 72 hours for processing. If your status has not changed to finalised OR it has been changed to finalised but has not been updated on your ATO portal, please feel free to resubmit the STP finalisation again and if it still does not submit please contact us at hello@payroller.com.au

Learn more about our useful features and functions in Payroller with our other handy guides:

Setting up 2FA on a new mobile phone device

Make an online tax file number (TFN) declaration

Finalise reporting for the financial year

Set employees up on different pay periods

Approve leave requests made by employees in the Payroller Employee mobile app

Discover more tutorials for using Payroller

Learn more about useful features and functions in Payroller with our simple user guides.

Try Payroller for free and get started setting up employees for STP and payroll.

With a subscription to Payroller, you can access full features across both web app and mobile app. Learn more with our Subscription FAQs.